1. Share your Loan Enquiry with our associate

Minimum Documentation (Personal & Company Details- PAN, Adhaar, and Company Documents)

1. Share your Loan Enquiry with our associate

Minimum Documentation (Personal & Company Details- PAN, Adhaar, and Company Documents)

2. Generate Faster Approvals :

* Get your files run across 50 + Banks & NBFC's

* Maximum 3 Days for Loan Sanction

3. Loan Disbursal direct to your Bank

Eg: If you withdraw ₹1 lakh at 1.5% pm and repay in

20 days, you pay only Rs 1,000 as interest.

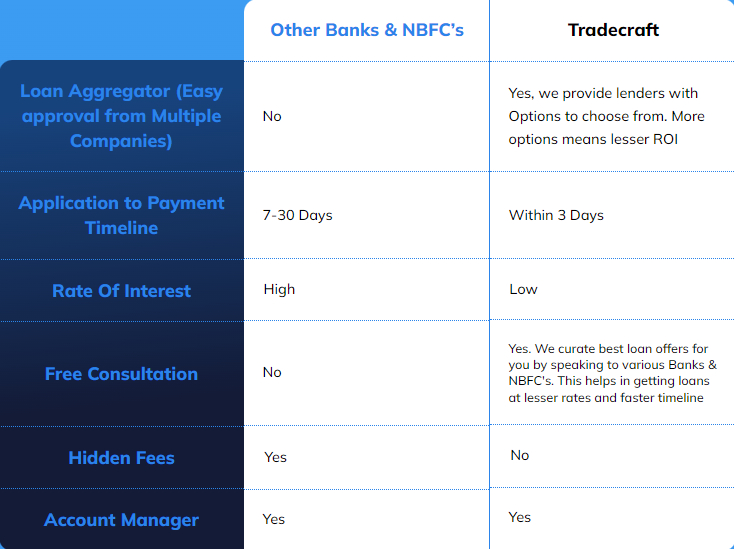

Why should you come to Tradecraft for your Business Loans?

Nagarajanna Varghese - Thank You Tradecraft for processing Business Loan for my manufacturing unit within 3 Days! This enabled me to get more Business and ease on payment stress from Creditors

After checking with Banks, I reached your website. Thank you for processing quick personal loan on my salary during personal emergency

Thank you for Free Consultation for Financing my New Home

Thank you for providing CC Limit for my Music Shop. Helped Grow Customers

Thank you for Free Consultation for Financing my New Home

B-707, Kailas Business Park. Hiranandani-Vikhroli Link Road. Vikhroli-400079. Mumbai

karan@tradecrafts.in